what is a tax lot in real estate

A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices and you enter a trade to sell only part of the position. 250000 of capital gains on real estate if youre single.

5 Reasons You Should Buy A Home Right Now Home Buying Real Estate Infographic Real Estate Buying

For married folks filing jointly its 501600.

. The legal basis is Title II of the Local Government Code LGC Republic Act RA. What is tax lot in real estate. If that doesnt work look to the comps and your land itself to make a case for why the assessed.

Real Property Tax is the tax on real property imposed by the Local Government Unit LGU. In New York City what is the difference between a building lot a zoning lot. Finally the tax lot includes the sale price of the securities in the lot.

Tax lot identification methods are offered by brokers when investors want to sell a percentage of a position that was purchased at different times and prices. The Department of Finance DOF collects more than 358 billion in revenue for the City and values more than one million properties worth a total market value of 11 trillion. A record keeping technique that traces the dates of purchase and sale cost basis and transaction size for each security in your portfolio even if you make.

Also the property should be the primary home of the owner. They are calculated based on the total property value and total revenue need. The tax assessor determines the millage rate in which the taxes are assessed.

Due to the decline real estate values in many communities there were property tax reassessments in order to reduce property taxes to the correct level. To appeal your property tax assessment start by digging into the data. If youve depreciated the property you might pay a different rate.

In most cases the tax lot and zoning lot are the same but a zoning lot can be made up of multiple tax lots. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning. TimesMachine is an exclusive benefit for home delivery and digital subscribers.

The tax rate on long-term capital gains tops out at 20 for single filers who report over 445850 or more in income in 2021. Get In-Depth Property Reports Info You May Not Find On Other Sites. In real estate a lot or plot is a tract or parcel of land owned or meant to be owned by some owners.

Pull up your propertys record card and look for discrepancies in the description of your land since if they exist you should have no trouble getting a fast adjustment. Accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities. Moreover properties that qualify for the rebate include one- two- or three-family residences or dwellings in a cooperative or condominium.

Tax maps show the lot lines the block and lot numbers the street names lot dimensions and easements. Accounting taxation US A grouping of security holdings in an account used for enabling the calculation and treatment of the securities. Each tax lot therefore will have a different cost basis.

A tax lot is a real property recorded on the City Tax Map and a Zoning Lot is the extent of land to be treated as one lot for the purposes of assessing the Zoning. Public Property Records provide information on land homes and commercial. Large amounts of property data are collected and made available through this website.

These stimulus checks from New York City will go to homeowners with a combined income of 250000 or less during the 2020 tax year. What is tax lot in real estate. The official tax maps for the City of New York are maintained by the Tax Map Office.

For example if you buy a rental house at 300000 take depreciation deductions of 100000 over the years. Tax maps show the lot lines the block and lot numbers the street names lot dimensions and. It gives homeowners a chance to pay those taxes along with high penalty fees.

The IRS typically allows you to exclude up to. Ad Search 1000s of land for sale listings near you. Usually it is a percentage like 15 or 2 of the market value of the home minus homestead exemptions.

What is a tax lot in real estate. The usual arrangement on which party pays what taxes in a sale transaction is as follows. 500000 of capital gains on real estate if youre married and filing jointly.

The City Register records and maintains all official. In comparison the rate for provincial areas is 1 of the assessed. Income tax if the property to be sold is an ordinary asset.

The rate of real property tax within the Metropolitan Manila Area is 2 assessed value of the real property. Real Estate 1 Renovations 49 Residential 3 Restoration 2. Tax Lot Accounting.

By comparing the sale price to the cost basis you and the IRS make an accurate determination on the profits or taxable capital gains generated in the transaction. For example if you sold the investment that cost you 100599 in the example above for 1200 youll. 250000 of capital gains on real estate if youre single.

A tax lien sale is a method many states use to force an owner to pay unpaid taxes. Data and Lot Information. We are required by law to track and maintain this information and to report the cost basis and.

Ad Looking for Corinth Tax Records.

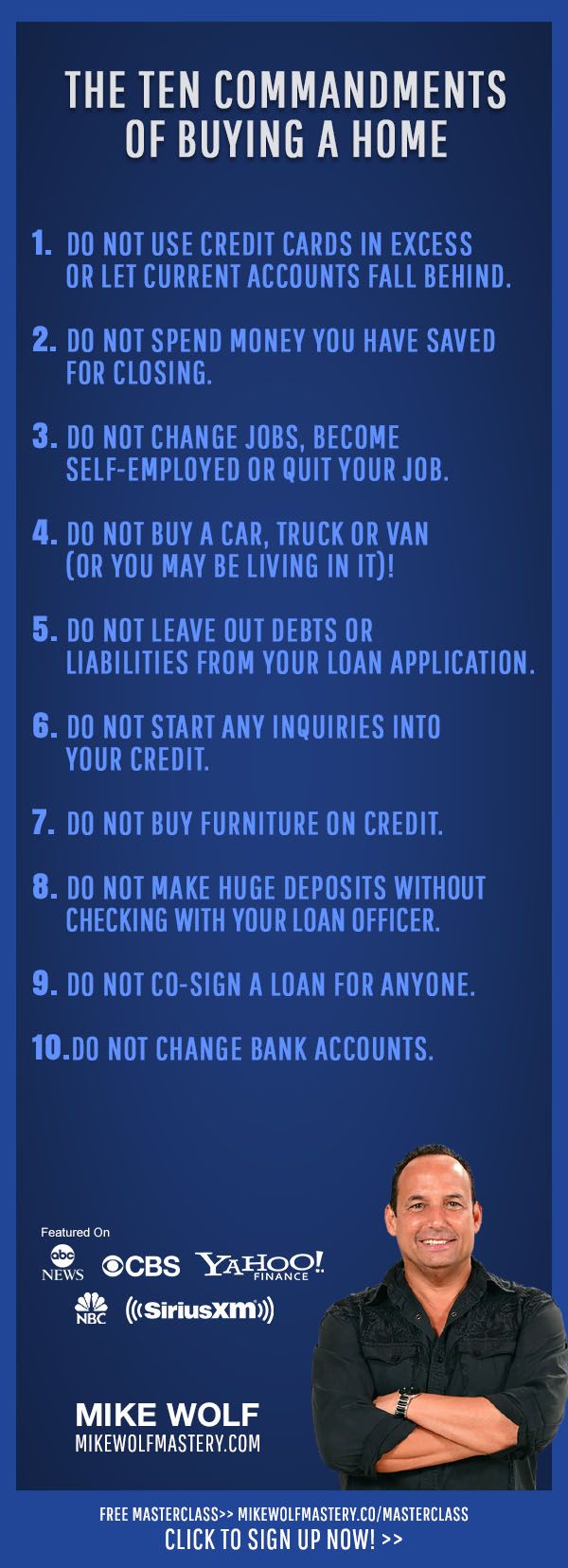

Mike Wolf Mastery Online Master Class How To Invest In Real Estate The Safe And Easy Way Even If You Don T Have A Lot Of Money

Tax Guide For Canadians Buying Us Real Estate Infographic Tax Guide Us Real Estate Blog Taxes

Good Investment Deals Best Investments Investment Accounts Real Estate

Being A Landlord Or Property Manager Is A Lot Of Work Learn How You Can Manage Your Properties Easily Wit Property Management Being A Landlord Rental Property

How To Lower Your Property Taxes Commercial Real Estate Investing Estate Investing Property Tax

Consider Capital Gains Tax On Home Sale Sale House Greenhouse Plans Diy Greenhouse Plans

Best Tips For Lowering Your Property Tax Bill Property Tax Real Estate Articles Mortgage Savings

2021 Real Estate Myth Buster Infographic Real Estate Myths Myth Busters Real Estate Marketing

Air Rights Architecture Diagram Architecture Design Process Floor Area Ratio Building An Addition

Faq In Real Estate Investing Are Rental Properties Profitable Real Estate Investing Rental Property Rental Property Investment Estate Investing

18 Different Ways To Invest In Real Estate Key Real Estate Resources Real Estate Investing Rental Property Real Estate Investing Real Estate Tips

Finding A Seller S Agent For You Real Estate Agent Marketing Real Estate Tips Real Estate Marketing

5 Most Overlooked Rental Property Tax Deductions Accidental Rental Rental Property Rental Property Management Real Estate Rentals

How To Increase The Roi Of Your Real Estate Investment Portfolio Epic Real Estate I Investissement Immobilier Locatif Immobilier Locatif Conseils Immobiliers

Top 13 Rental Property Tax Deductions Rental Property Investment Real Estate Investing Property Tax

10 Tax Deductions For Real Estate Investors Morris Invest Real Estate Investing Rental Property Wholesale Real Estate Real Estate Investor